East Mediterranean Gas: Regional Cooperation or Source of Tensions?

A series of major natural gas discoveries made in recent years and the prospect of substantial hydrocarbons resources waiting to be tapped beneath the Eastern Mediterranean waters have sparked major international interest. If developed in a successful way, they may significantly change the energy picture in the wider Mediterranean region. They may also be a force that promotes energy security, economic prosperity and regional cooperation. If not, they might become a main component of the geopolitical struggle, fuel existing disputes and add to the various frictions and anxieties in the region and beyond.

This article discusses the recent exploration activity, the possibilities of gas exports and export destinations, the options for export infrastructure, and gives an overview of their potential impact on the conflict-laden geopolitical landscape of the region.

A promising hydrocarbons province is re-emerging

Offshore drilling in the Eastern Mediterranean has a rather short history. The first offshore gas discovery was made in 1969 in Egypt (34 km northeast of Alexandria). A new wave of interest developed after a handful of modest gas discoveries occurred in 1999 and 2000 at shallow depths west of the coastal town of Ashkelon in Israel and Gaza Strip. These successes accelerated exploration efforts resulting in three large scale discoveries: Tamar and Leviathan fields in 2009 and 2010 offshore Israel and Aphrodite in 2011 off the coast of southern Cyprus (RC). The next big discovery came in 2015 with the giant Zohr gas field in a deep offshore zone of the Mediterranean, off the coast of Egypt.

And yet, the region remains one of the world’s most under-explored or unexplored areas and has good prospects for additional gas, and perhaps oil, reserves. Two assessments by the United States Geological Survey (USGS) in 2010 –one on the Nile Delta and Mediterranean Sea sectors of Egypt, the other on the Levant Basin Province– indicated almost 10 trillion cubic meters of technically recoverable undiscovered gas potential in the region. To put this into context, Algeria’s current proven gas reserves is about half of it.

The above mentioned discoveries, the USGS assessment as well as the eye-opening resource potential estimates by Cypriot and Lebanese officials, have not only significantly augmented hopes for large natural gas potential in the East Mediterranean but also made it a fast rising favorite for international oil and gas companies.

In Israel, the Tamar field, estimated to contain 282 bcm of natural gas, started production in March 2013 Today, 60% of the electricity generated in Israel comes from gas produced from Tamar. Developments of the Leviathan field -resource potential estimated at 621 bcm– and others have been jeopardized or unable to proceed as a result of numerous political and regulatory obstacles such as the allocation of discovered resources into exports and domestic market, taxation and administrative uncertainties, and an anti-trust ruling stemming from the concerns that the two leading companies active in the Israeli upstream sector constitute monopoly. Progressively these uncertainties have been lifted and with the approval of the Supreme Court in May 2016, the so-called Natural Gas Framework has been established.

The removal of regulatory uncertainties and risks following the approval of the new gas sector framework by the government paved the way for a resurgence of exploration activity. In November 2016 the Ministry of Energy has launched Israel’s first offshore bidding round for licensing new exploration areas, with closing date for bid submission July 2017. Results are expected in 2018. Meanwhile, in February 2017, the Final Investment Decision has been taken for the first stage development the Leviathan field. The plan has a proposed budget of $3.75 billion with a capacity of 12 bcm per year of gas starting by yearend 2019.

In Cyprus, three offshore bidding rounds were held to date. Negotiations with the selected bidders for the offshore hydrocarbon exploration licenses for three blocks offered in the last bidding round in 2016 were completed in early March 2017. Approval by the government is expected soon. Despite successful bidding rounds, exploration activities so far have been rather disappointing. To date only one discovery (Aphrodite field, estimated to hold 128 bcm of gas, in December 2011) was made. The development program for the field has been presented in June 2015, with an estimated production capacity of 8.2 bcm/yr. The investment, excluding the cost of building a pipeline, is estimated to be around $4 billion. The final investment decision is hoped to be taken soon. If everything goes well, start of commercial flows from the fields to domestic and foreign markets are expected in 2020. The discovery of new fields would be a game changer for Cyprus, since the Aphrodite field alone does not allow the set-up of any export infrastructure and export plans.

Egypt is a country with an old history of oil and gas production. Egypt enjoyed total energy independence and could export gas through two liquefaction terminals and two pipeline pipelines linking it to Israel and Jordan. Declining production and booming domestic demand have made the country recently a net gas importer. Recent discoveries, particularly the Zohr field in 2015 -with 845 bcm of gas in place it is considered as the largest ever gas discovery in the Mediterranean Sea- has radically changed the picture. Ongoing fast-track development program foresees first gas deliveries at the end of 2017, and an estimated peak production of 27 bcm/y by 2019-20.This success, which is regarded as a geological game changer, is stimulating new exploration activity from various major international companies in the country.

In the other countries of the region perspectives have been less optimistic.

In Lebanon, extensive seismic research conducted over 80% of the country’s exclusive economic zone shows promising prospects, but the country’s first offshore licensing round, launched in the early 2013, was postponed 5 times because two decrees related to delineation of offshore blocks and model agreement to carry out the licensing round could not be approved by the government due to political chaos and institutional vacuum. Finally these decrees were ratified in January 2017 and hence the process has been launched. Bids for 5 blocks (three of which are in the disputed zone with Israel) are due by mid-September. Agreements with winners are scheduled to be signed in November.

In Syria in December 2013, the government signed an exploration agreement with the Russian company SoyuzNefteGaz. Nevertheless with the conflict still raging, no progress has been registered and any development seems unrealistic.

Turkey has drilled 13 wells in the Mediterranean waters between 1966 and 2016 but no commercial quantity of hydrocarbons was discovered. However, exploration activity in terms of seismic acquisition in the area has been increased recently.

Monetisation options and possible export routes

Discoveries make sense if reserves are converted into production capacity. Companies will carry on costly exploration and field development endeavors if they see the ability to commercialize their discoveries with a favorable rate of return. Much will depend on the gas price the companies will receive in selling natural gas to the domestic market, the availability of export options and transport means, stability in the countries’ regulatory, fiscal and political environment. In other words, serious companies do not make investment decisions due to hype or illusion.

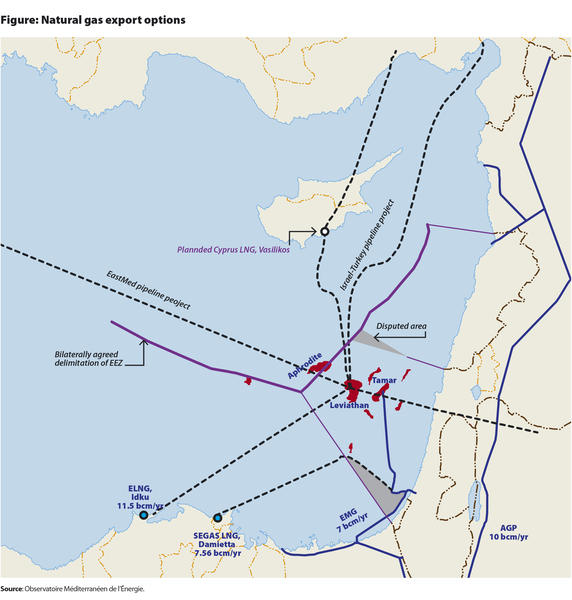

Offshore discoveries in Israel and Cyprus contain more than enough gas to meet their needs for decades and therefore the development of the fields require exports to foreign markets. Several agreements to export Israeli gas from the Tamar and the Leviathan field (to the Palestine, to Jordan, and to Egypt) have been signed; and discussions are going on to bring gas from Cyprus to Egypt.

However, the prospects of exports to Egypt or the use of the existing infrastructure of the two LNG (Liquefied Natural Gas) plants located in Idku and Damietta, which have a combined capacity of 19 bcm per year, to re-export are dim in the medium to long term. It is because Egypt may no longer require gas imports for domestic use and may start exporting gas again in the early 2020s when production from Zohr and from other fields catches up with demand. Moreover, the owners of LNG plants may give preference to local production.

Therefore Israel and Cyprus share interest in jointly developing transportation options that would allow reaching more distant markets. Three options have been discussed: LNG, pipeline to Turkey and pipeline to Greece. However, each option faces several technical, administrative, commercial, security, legal and political challenges with geo-political implications.

1/ Transforming the gas in LNG means gaining access to a world-wide market, with cargos that could go to Europe, as well as to Asia or to South America. An LNG facility could be built either at Vassilikos on the south coast in Cyprus (given that Leviathan is located halfway between Israel and Cyprus), or on Israel’s coast, or in Jordan’s special economic zone at Aqaba on the Red Sea. A Floating Liquefied Natural Gas (FLNG) facility has also been contemplated. The feasibility of this option is challenged by the high costs and the current overcapacity in the LNG market which is expected to last at least another five years. As mentioned above, the use of the LNG plants in Egypt may not be possible.

2/ There has been a considerable commercial interest by companies in Turkey for buying Israeli gas by pipeline. Building a pipeline from the offshore fields to the southeastern Mediterranean coast of Turkey either directly or indirectly (via Cyprus) could allow any mix of Israeli and Cypriot gas to target the Turkish market or even to access the European markets through the Southern Gas Corridor which is under construction (composed by the Trans Anatolia Natural Gas Pipeline, TANAP, which originally will bring Azeri gas to the Turkey-Greece border and by the Trans Adriatic Pipeline, TAP, which crosses Greece and Albania to reach the southern coasts of Italy) or through the existing infrastructure owned by Botas. Pricing issue aside, to be successfully implemented this option requires the resolution of the Cyprus problem.

3/ The Eastern Mediterranean Natural Gas Pipeline project (Israel-Cyprus-Greece-Italy), a 1700 km-long project, could also link Israel and Cyprus to European gas markets. This project has been approved by the EC as a project of common interest, making it eligible for EU funding. Although this option is argued to be technically feasible, financially sustainable and commercially competitive, its implementation might be challenging since it could cause serious political problems with Turkey, due to the disputes over maritime delimitation.

Source: Observatoire Méditerranéen de l’Énergie

Currently, the focus appears to be on developing gas pipelines for the export of gas to the immediate neighbors.

Geo-political implications

Exploitation and export of hydrocarbons resources in the Eastern Mediterranean present enormous technical, administrative, security, legal and political challenges with geo‐political implications.

The technical challenges are centered on infrastructure and financing. For instance, although all the export options mentioned in the previous section are technically feasible, the costs involved, the complexity of negotiating the necessary deals as well as overcoming political barriers pose serious obstacles to the development of discovered gas resources.

Administrative challenges include the governments’ ability and the long-term vision to make best use of the reserves. Unfortunately, no country in the region has yet developed a comprehensive and successful policy that takes into account of these challenges combined with the region’s geopolitical changes.

Security challenges come along with perturbed political relations between the countries in the region. These include the persistent conflicts between Israel and its neighbors (the state of war between Lebanon and Israel and decades long conflict between Israel and the Palestinians), the unresolved Cyprus problem, and finally the ongoing unrest in Syria and its impact on the neighborhood.

Legal and political challenges are being manifested in the debate and dispute over conflicting claims about the ownership of resources and the demarcation of maritime borders, namely between Lebanon and Israel, between the Republic of Cyprus, Turkey and Turkish Republic of Northern Cyrus. This is arguably the most pressing challenge.

Maritime borders between Lebanon and Israel have never been agreed upon or delimited officially and are an ongoing source of tension. So far, attempts by the United Nations and the US to resolve the dispute between the two countries have failed.

An even more complicated case is the one between the RC, Turkey and TRNC. Turkey’s disagreement with the RC concerns the overlapping claims in offshore areas located in the west and south east of the island. Turkey claims that maritime demarcation agreements signed by the Greek Cypriots with countries of the region are null and void due to several reasons. First, Turkey does not recognize the Republic of Cyprus and hence its proclaimed EEZ in 2004. Second, Turkey argues that the Greek Cypriot government does not represent the Turkish Cypriot population. Third, Turkey and TRNC argues that Greek Cypriot unilateral exploration operations are hurting the reunification negotiations. They propose suspension of all activities or setting up a joint committee related to hydrocarbon reserves off the island until the reunification process of both communities of the island is concluded.

Disputes could also develop about the delimitation of the geological structures of gas fields when they are very close to the EEZ borders and possibly overlapping them. The existence of reservoirs overlapping the EEZs could imply a joint exploitation of the field which would require a kind of unitization agreement, but could also generate tensions between the involved countries.

Meanwhile the opportunities linked to the gas production are also generating various economic and diplomatic initiatives among different countries. In the past few years, two tripartite alliances have emerged. One is between Greece, RC and Egypt, and the other is between Greece, RC and Israel. High-level political and technical meetings have reinforced tripartite summits bringing top officials from Greece and RC together with their Israeli and Egyptian counterparts. At the same time, relations between Egypt and Turkey have deteriorated, while relations between Egypt and Israel have improved.

These developments were not surprising. RC has been implementing a dramatic pro-Israel shift in its foreign policy supported by public opinion even though it traditionally followed pro-Arab tendencies by adopting a vocal pro-Palestinian stance in the Arab-Israeli conflicts. While the hope of obtaining Arab support in the UN and other organizations was perhaps the main culprit, at the same time RC has resisted Arab pressures to cut diplomatic ties and dampen flourishing economic ties with Israel. At the same time, RC has maintained a balance between the EU, the US and Russia rather successfully.

Concerning Israel, natural gas resources offers an opportunity to improve relations with its neighbors. Hence a number of export agreements have been signed or are under discussion to sell gas from the Tamar and the Leviathan field to customers in Palestine, in Jordan and in Egypt.

In the same time despite all the rhetoric about being a regional and global leader - Turkey appears isolated in eastern Mediterranean. For energy transportation Turkey enjoys an unquestionable pivot position between the Middle East, the Caspian area, the Black Sea and South East Europe; nevertheless political and geopolitical developments in recent years has weakened Turkey’s international image and impact in the world politics. It is yet to be seen whether the warming relations with Israel and Russia will change this picture.

Regional cooperation: source of tensions or national developments?

The discovery of hydrocarbon resources presents a rare window of opportunity for regional cooperation, long term energy security and prosperity. Exploitation and transportation of these resources in a timely and effective way could pave the way to minimize the time-to-market and maximize the access to more valuable markets. Open and effective cooperation between the different countries and the energy companies active in the area could produce “optimal” investment decisions, such as the development of joint export infrastructure for fields located in different countries. As mentioned by Amos J Hochstein, US former Special Envoy for International Energy Affairs, countries will save billions if they share infrastructure and market access. If they don’t share those resources, most of the gas will have to stay in the ground.

Converging economic interests could act as a strong motivation for achieving political agreements between the different countries, where governments’ actions could receive support by representatives of civil society and economic actors.

The European Union has also interest in promoting all possible forms of regional cooperation. From an energy viewpoint Eastern Mediterranean gas can strengthen the EU’s security in terms of diversifying supply sources and routes for a number of member states, particularly in Southeast and Central Europe, which are almost exclusively dependent on Russian gas. From the political standpoint the Republic of Cyprus is a member of the European Union and close relations exists with all the countries concerned. Turkey is a candidate for EU membership and is linked to the EU by an association agreement and customs union. Lebanon and Israel have association agreements with the EU and Israel is an active participant in the EU’s framework program for research and development.

The support for regional cooperation is also expressed by the United States in particular for security reasons, with Greece and Turkey being part of the NATO and Israel being a key US ally. And also due to the desire to contain the role of Russia in the region.

The risk of accrued tensions fueled by the exploration and exploitation of gas hydrocarbons and by the construction of transportation infrastructure is very real, at least between Turkey and RC and between Israel and Lebanon on the one hand and between Israel and Palestine on the other.

Apart from tensions between state entities, it must also be noted that the development of energy facilities increases the security risks. The proliferation of extraction platforms, pipelines, service ships and LNG terminals and vessels imply a multiplication of sensible targets and an increase in monitoring needs. Risks of sabotage, of military or terrorist strike represent new challenges for the security apparatus of the different countries, which will have a strong incentive to collaborate.

In particular looking more in detail the case of Israel, we can see that the production fields are located in relatively nearshore areas. For example, the Tamar field is located 56 miles west of Haifa and the Leviathan field 80 miles of Haifa, near the border with Lebanon. The gas from Tamar currently in production is transported through a pipeline whose arrival terminal is located in Ashkelon, a few kilometers from the border with Gaza. All these industrial facilities are therefore exposed to the risk of attacks from outside. For this reason, Israel has purchased four corvettes which will be delivered by 2020 and requested 8 SeaHawk helicopters from US Navy Surplus to be used on board these frigates in order to patrol and protect gas fields in the Mediterranean as well as other areas under threat.

Between hopes of regional cooperation and increase in security tensions, it is possible that the pragmatic balance would be found in the favor of national-oriented developments. The action of the private companies involved in the different projects could also push for this. Energy companies need a clear economic, legal and administrative framework in order to formalize their investment decisions, attract financing for their projects and start the implementation of their projects. This is even truer in the current environment characterized by low energy prices, overcapacity in the LNG market and potential price war in the European gas markets between piped gas and LNG.

The fast track development of the Zohr field in Egypt is proving this trend, since the production will be devoted, at least in the initial phase, to satisfy the local demand. Also the recent developments in Israel seem going towards the use of gas more for local consumption (industries that could create more value-added, gas to liquids projects and use of gas for transport) and for exports to countries nearby – as shown by the discussions to export from the Leviathan field to Palestine and Jordan, and recently commenced gas export from the Tamar field in Israel to two companies in Jordan. The case of Cyprus appears more critical. Unless new discoveries are made in the future, the Aphrodite field alone does not justify the construction of any major export infrastructure to foreign markets.

In the next five years, national oriented and local developments as well as expected gas prices would make the buildup of ambitious projects less probable. Hence the international relevance of the Eastern Mediterranean gas province should be seen in a longer term.

Concluding remarks

Hydrocarbons will be a dominant factor in the future of the countries of the East Mediterranean and beyond, at least in theory. Large discoveries since January 2009 and the prospect of substantial hydrocarbons resources waiting to be tapped beneath the eastern Mediterranean waters have opened up a new deep-water province and sparked major international interest.

These resources present a rare window of an opportunity for regional cooperation, long term energy security and prosperity. Unless developed for the benefit of all, they may fuel confrontations, add frictions to an already volatile region, and in some cases, might even escalate into a full scale confrontation.

Getting the countries in the region to collaborate and cooperate is a formidable diplomatic challenge that needs to be overcome. A multilateral forum between all countries in the region could be a good start to establish a balanced but pragmatic approach, enacted through a constructive and frank dialogue between the different countries and actors. This could, potentially, redraw the whole political and economic map of the region in a way that benefits all parties. However, unless the actors in the region talk to each other, these opportunities will be lost, and substantive compromises are unlikely to be reached.

E-ISSN: 2013-4428

D.L.: B-8439-2012